Our platform is designed for financial institutions to handle disputes with speed, accuracy, and transparency. By combining advanced AI with deep payments expertise, we help issuers deliver seamless dispute resolution while reducing operational costs.

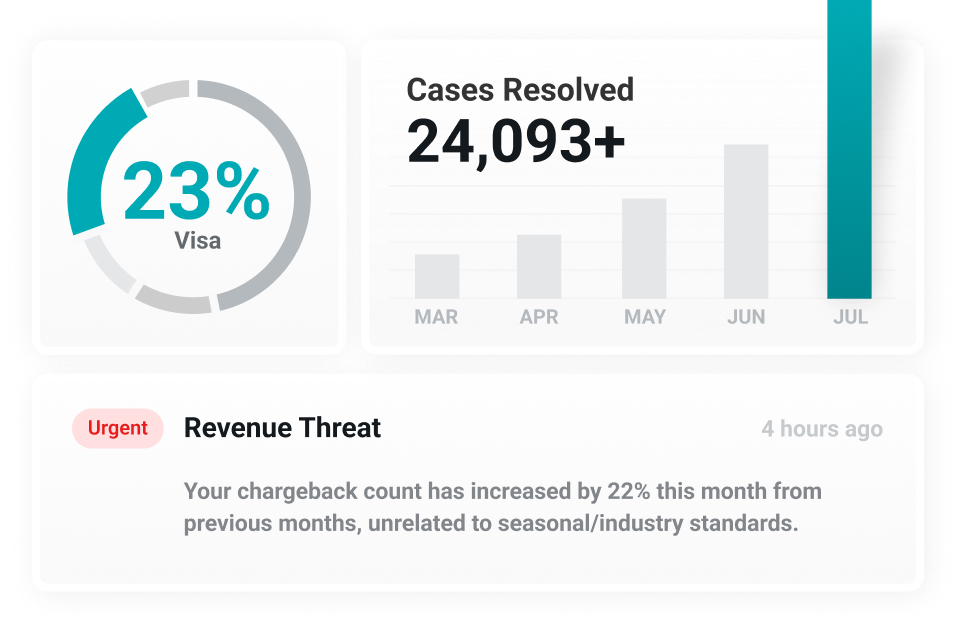

AI-powered case insights — helping financial institutions reduce write-offs and improve reimbursement rates.

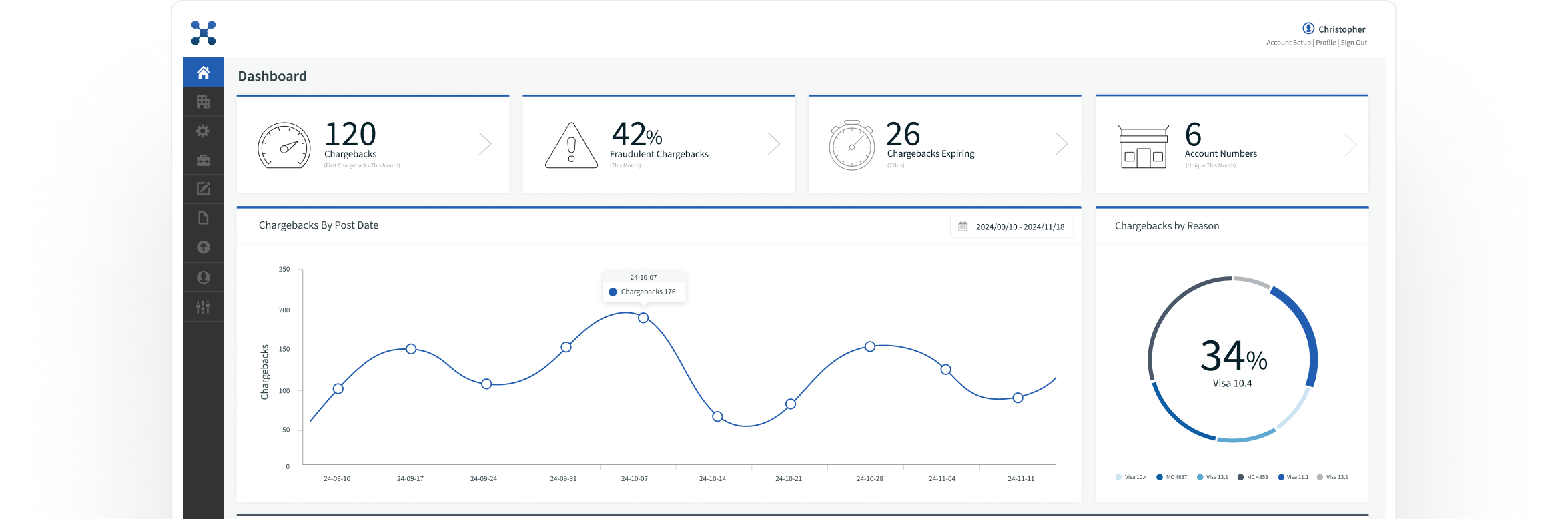

End-to-end accountability into dispute volumes, fraud patterns, compliance, and team performance to improve efficiency and decision-making.

Streamlined workflows and automation reduce investigation time by up to 60%, ensuring faster responses and higher cardholder satisfaction.

Unlock tools built for financial institutions to strengthen compliance, reduce write-offs, and operate more efficiently at scale. With automated workflows, advanced analytics, and fraud insights, you can resolve disputes faster, keep pace with rule changes, and deliver a better experience for every cardholder.

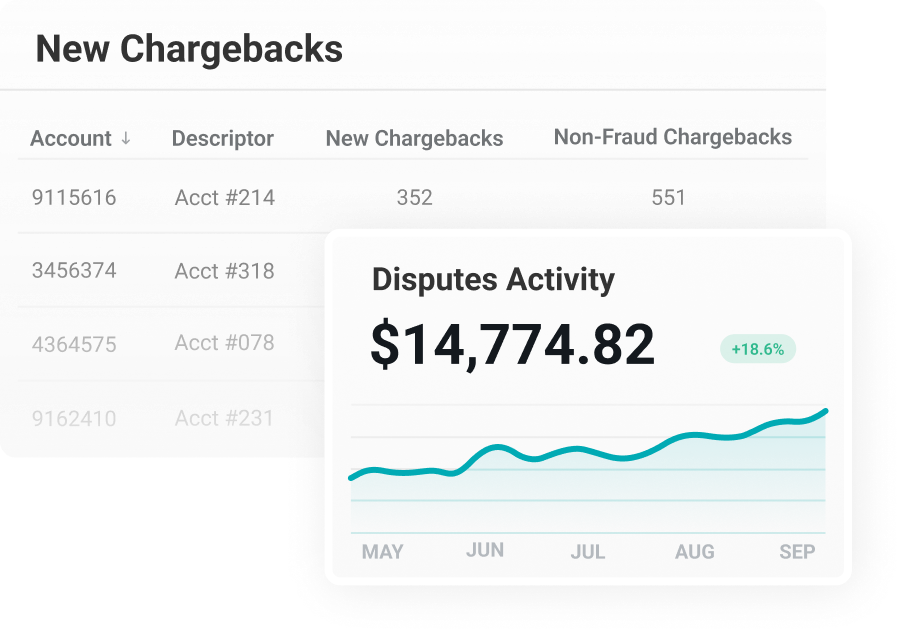

Prevent invalid disputes, eliminate costly errors, and maintain regulatory compliance at scale with automated, intelligent workflows designed to streamline case management.

Automated workflows and optimized intake and resolution tools help your teams investigate and resolve disputes efficiently, ensuring compliance while improving financial impact.

Access deep analytics on dispute trends, fraud patterns, and regulatory risk. Gaine the visibility you need to reduce errors, strengthen compliance, and streamline back-office operations.

From growing teams to large-scale operations, our plans deliver compliance, reduced write-offs, and efficiency at every level.

Ideal for financial institutions managing moderate dispute volumes.

Best for financial institutions scaling operations and compliance oversight.